PHCC Member Survey Cites Cautious Industry Optimism, But Challenges Still Ahead

Plumbing-heating-cooling contractors are feeling cautiously optimistic, according to a new report from the Plumbing-Heating-Cooling Contractors — National Association. The PHCC Business Intelligence Department released its newly developed Contractor Confidence Index. Sponsored by PHCC Strategic Partner Bradford White, the PHCC CCI is based on a quarterly survey of PHCC members designed to take the pulse of the plumbing, heating and cooling market.

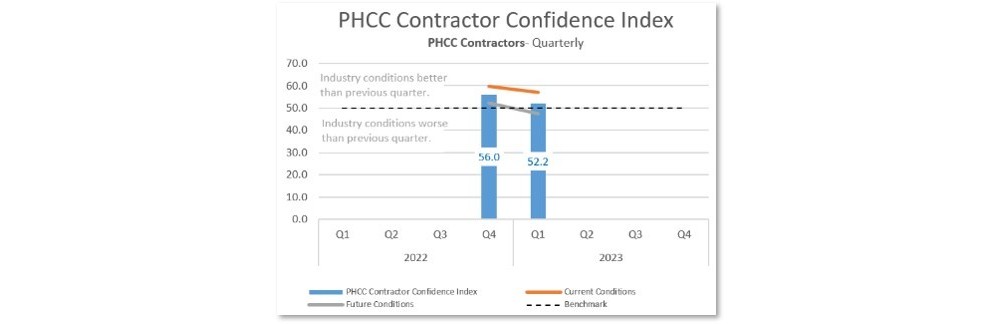

The PHCC First Quarter 2023 CCI summary report revealed a CCI of 52.2, meaning contractors believe industry conditions are better than the previous six months, but are trending lower because of ongoing challenges. The first quarter CCI dropped from 56.0 in the fourth quarter of 2022, with an increasing number of respondents citing economic uncertainty and fear of a coming recession.

Any rating over 50 indicates a higher share of PHCC contractors reporting industry conditions are better than they were in the previous quarter, while any rating under 50 indicates a higher share of respondents reporting conditions are worse than they were in the previous quarter.

Plumbing contractors reported a lower future confidence index of 42.2%, versus 48.9% in the fourth quarter 2022, indicating that contractors who own plumbing businesses believe industry conditions were worse than the previous six months. HVAC contractors reported a higher future confidence index of 56%, versus 60.6% in the fourth quarter, suggesting industry conditions still feel better than the previous six months, though sentiment is trending lower.

The top contractor challenges reported were:

- Operating short-staffed

- Customers holding off on projects

- Low call volumes

- Too much work

- New construction slowdown.

While roughly 70% of PHCC contractor respondents anticipated normal to better sales in the future, 30% of respondents are not operating with a full staff, employees and technicians. Double the number of respondents reported that customers are holding off on projects and replacements due to economic concerns — a significant increase when compared to fourth quarter results. 72% cited rising costs, and half of the respondents noted delays in shipping materials. The results were flat at 25% for those who indicated concerns about lower construction starts when compared to the last quarter.

Looking ahead, 73% of PHCC respondents are anticipating increased cost of doing business (parts, materials, labor), and most of those respondents are worried about an impeding recession, as well as continued challenges finding qualified employees and technicians.

The top three concerns for contractors over the next six months include the cost of health insurance, fear of recession and increased (additional) insurance costs. Additional concerns were increased regulations, decreased construction starts and cash flow.

For more information, visit phccweb.org.